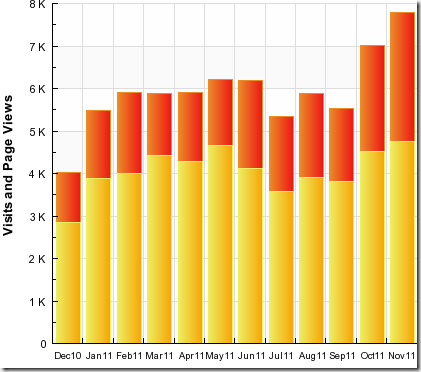

This morning's muse starts with last months stats. The graph shows visits (yellow) plus page views (yellow plus red) to this blog over the last twelve months.

Looking at the detail inside the statistics, both last and this month have been marked by visits from some strange sources. I won't give examples because the sites in question are quite suspect.

This means, I think, that the apparent increase in blog traffic is either not real or at least distorted.

Here in Australia, the Australian Labor Party has been holding its triennial National Conference. This sets the Party's National Platform

The significance of the National Platform lies not so much in it's influence on what the Labor Party actually does, but on what the Party doesn't do. If something is proscribed in the Platform, then a Labor Government will struggle to do that thing.

An example is sales of uranium to India, something that the Government wishes to do. The Platform needs to be amended to allow that to happen. This seems likely.

This year gay marriage has been the main headline event. Examples of reporting here and here. This one is interesting because it crosses factional divides within the Party. It seems likely that support for gay marriage will be included in the Platform, but that MPs will be allowed a conscience vote on the issue in Parliament.

Past conferences provided good theatre. Today, the conferences are essentially micro-managed with agreements reached before matters reach the floor. They tend to be duller as a consequence.

I listened to the PM's opening remarks to the conference. She is a bright woman. I wonder why she feels obliged to speak in sometimes clumsy and extremely repetitive one line slogans. Among other things, it opens her up to a degree of ridicule.

I have been watching events in Europe with a degree of bemusement. I haven't attempted to do a detailed analysis because I just don't understand the issues well enough. Perhaps more precisely, I don't understand the politics well enough.

I think it reasonably clear now that the best option would have been to allow Greece to go into a structured default. This could have been managed without affecting the Euro. However, that is now history.

When I look at the position now, I keep coming back to very basic principles:

- Policies that can work for one country in isolation such as budget cuts and economic restructuring do not work especially well if too many countries do it at the same time.

- Credit creation is in reverse. If you look at the old analysis of money, the banking system lends a dollar that is then re-deposited and can be relent. Credit is created, the money supply expands, bank profits go up. Conversely, if a dollar is withdrawn, then loans are reduced by a multiple of that dollar, the money supply contracts, bank profits go down.

- To my mind, Europe is in that position now. There is actually plenty of basic liquidity splashing around, but it has no where to go. Banks are caught in a squeeze with now suspect assets, declining business, suspect profitability. Problems are further complicated by fund flows between countries, from a Spain or a Greece to safer havens, creating very specific liquidity pressures.

- A lot of the discussion has focused on de-leveraging, and that's important. But in downturn, fixed costs become important. A cost that was once acceptable suddenly becomes a huge burden, leading to knock-on effects.

The policy positions adopted to give the backs continuing access to cash may be necessary just to keep things going, but they do nothing to address the underlying forces.

Where am I going in all this? I'm not quite sure.

Despite all talk to the contrary, I very much doubt that the Euro will collapse. Too much is at stake. I also do not expect catastrophic bank failure. Again, too much is at stake. I do expect Europe as a whole to experience a rather nasty recession. I also feel that all this will leave both the EU and national governments weakened, delaying recovery.

And Australia? That's a story for another post.

No comments:

Post a Comment